Trends

Cannabis App Development

Cannabis Data & Marketing Insights You Should Pay Attention To

Posted by: Nikki Tabberrah

September 14, 2023

We've collated key insights from cannabis market research firms, Canna software solutions, retail strategists, and marketers.

Here are 7 crucial takeaways that you might find interesting:

September 2023 Market Overview: The Front-Runners, the Steady Performers, and the Lay Lowers

In an insightful overview of the current state of the marijuana market across the United States, data from Headset reveals a complex mosaic of growth, stability, and contraction.

Maryland is a rising star in this landscape, with its market growing 5% in its second month since launch, generating $91.7M in sales. Florida is flourishing as well, charting a robust 17.6% market growth compared to August 2022.

Michigan's cannabis market has displayed a significant surge with a remarkable 31.5% growth in August translates to a market value of $273,304,741 for the month showing this market’s vast potential.

California, despite a 9% contraction in August, still boasts an immense market volume at $377,180,195. According to Headset, this dip could potentially signal early signs of market saturation, but the sheer size of California's market remains awe-inspiring.

Colorado, despite experiencing an 11.3% year-to-date dip, maintains a significant market presence. While this contraction reveals certain challenges, the state's persistent presence in the market cannot be overlooked.

Finally, Washington and Oregon stand as steady states in the cannabis industry. Despite their respective contractions of 0.9% and 0.8% in August, they continue to be strong pillars in the industry. Their resilience and enduring market strength, as reported by Headset, are emblematic of their established status within the industry.

Basket Analytics

The cannabis industry is going through an interesting phase of transformation, as per the latest insights from Headset's Cannabis Market Overview. For instance, Maryland is experiencing a luxury trend, with an increase of 15.24% in the average price of items, suggesting a tilt towards high-end products.

However, not all states are seeing similar trends. The size of purchases, or 'basket sizes', are decreasing in some regions. California has experienced a 12.46% decrease, while Massachusetts has seen a more drastic drop of 18.64%.

In the case of Florida, the growth isn't just limited to market volume. The state has seen a significant increase of 33.84% in transactions, indicating a strong consumer base. At the same time, the average price of items varies across different states. For example, Illinois has noticed a 13.38% drop in its average item price. This could either be due to increased competition or the rise of a more price-sensitive consumer base.

These observations provide a glimpse into the dynamic nature of the cannabis market. While these insights represent only a fraction of the data available at Headset, they still offer a crucial understanding of the current tendencies and patterns shaping the sector.

Demographics Report 2023

Headset's 2023 demographic report offers critical insights into the cannabis consumer landscape in the United States and Canada.

Here are the key takeaways:

- Generation Z is the fastest-growing consumer group in the cannabis market of both countries, representing a significant shift in demographics.

- Despite this, Millennials continue to be the leading consumer group, with nearly half of every dollar spent on cannabis across North America attributed to them.

- Together, Millennial and Generation Z consumers account for 72.1% of all tracked sales in Canada and 63% in the U.S.

- Male consumers dominate the cannabis market, making up approximately two-thirds of all cannabis sales. Female consumers constitute the remaining one-third. However, Canada shows a higher representation and growth rate of female consumers compared to the U.S.

- Older consumers tend to favor traditional product categories like Flower and Edibles, while younger consumers lean towards newer formats such as Vapor Pens and Concentrates.

- Notably, Generation Z has become the first generation to spend more on Vapor Pens than on Flower products, marking a significant shift in consumption habits.

In essence, the report highlights the growing influence of younger generations in the cannabis market and the shifting preferences towards new product formats. It also underscores the importance of understanding these evolving demographics and preferences for businesses in the cannabis industry.

Customer Lifetime Value & Retention Rate of a Cannabis Retail Customer

Bobby Fatemi, co-founder and Head of Data Science at Happy Cabbage Analytics, conducted an in-depth analysis of the lifetime value (LTV) of retail customers for dispensaries. His study, which spanned five years and included data from five retailers, aimed to understand customer retention rate, order frequency, and total spending over time.

Key findings of the study include:

- Retained customers return every three weeks on average.

- These customers spend an average of $130 per order.

- Their loyalty spans an average period of three years.

- Over these three years, customers generated around $7,000 in sales.

However, the attrition rate is high, with only 16% of customers continuing to shop at the same store over the five-year period analyzed. The remaining 84% declined rapidly, with an 18% drop-off after just the first quarter. By the tenth quarter (approximately three years), the attrition rate reached 50%.

Despite the high attrition rate, the study revealed that retaining even a fraction of these lost customers could significantly bolster revenue. For instance, retaining 25% of lost customers over ten quarters (53 out of 212 customers in this case) could result in $371,000 in additional revenue.

The study also highlighted that cannabis customers often shop with the retailer that engages them at the right time and place, indicating the importance of timely marketing efforts. In conclusion, while acquiring new customers is essential, nurturing and retaining existing ones can lead to substantial revenue growth. Dispensaries should therefore prioritize and invest more in customer retention strategies.

Weedmaps Jack Prices Up 4x

The cannabis industry is experiencing a significant shift as Weedmaps, a prominent dispensary listing service, drastically increases its prices. This move has led many dispensaries and delivery services to explore alternative options. The basic marketplace listing rate has surged from $495 to $1,600 per month for each location, excluding premium listing. This marks a nearly 400% increase in the cost of securing a spot on Weedmaps, pushing many cannabis retailers to reconsider their investment.

This price hike has stirred a wave of reactions among key opinion leaders, cannabis retail marketers, and owners on LinkedIn, many of whom have expressed dissatisfaction with the change. One cannabis retail store owner, after eight years of using Weedmaps, decided to withdraw due to these recent changes.

Apart from the price increase, several other factors have contributed to a decrease in Weedmaps patronage. Some of these include the loss of "trap" shops on the platform, the growth of individual store platforms such as websites or apps, diminishing traffic and revenues per store, and a perceived lack of focus on the part of Weedmaps.

Furthermore, the trend of consumers starting their search for cannabis products on Google rather than on Weedmaps or other marketplace sites has contributed to the overall decline in demand for Weedmaps' services. As a result, many industry players are now prioritizing organic growth, investing in their own Google business listings or other branded channels. This shift in strategy questions the sustainability of Weedmaps' business model and indicates a potential paradigm shift in the cannabis industry.

Join the conversation at Deeproots on LinkedIn.

Distinct Perspective on Daily Deals

Krista Raymer, cannabis retail strategist and founder of Vetrina Group, has expressed her concerns about dispensaries' common practice of offering daily deals. According to Raymer, these daily deals may not be as beneficial for the industry as they seem.

Here's why:

- Conditioning Customers by Category: Daily deals often focus on specific categories, conditioning customers to buy only within those categories. However, the most valuable and loyal customers typically purchase across various categories.

- Creating Expectations for Discounts: When customers are continually offered discounts, they come to expect them. This expectation affects not only your store but also others, as discounts become a standard condition of sale for most consumers. While discounts aren't necessarily detrimental, they should be deployed strategically and with intention.

- Limited Promotional Length: Daily deals, by their very nature, are time-limited to one day. This short timeframe may not be sufficient to attract new customers or allow enough people to take advantage of the deal.

In summary, while daily deals might seem like an attractive marketing strategy, Raymer advises that they should be used thoughtfully and strategically. The aim should be to encourage cross-category purchases, avoid creating an expectation for constant discounts, and ensure promotions have enough duration to attract a wider customer base.

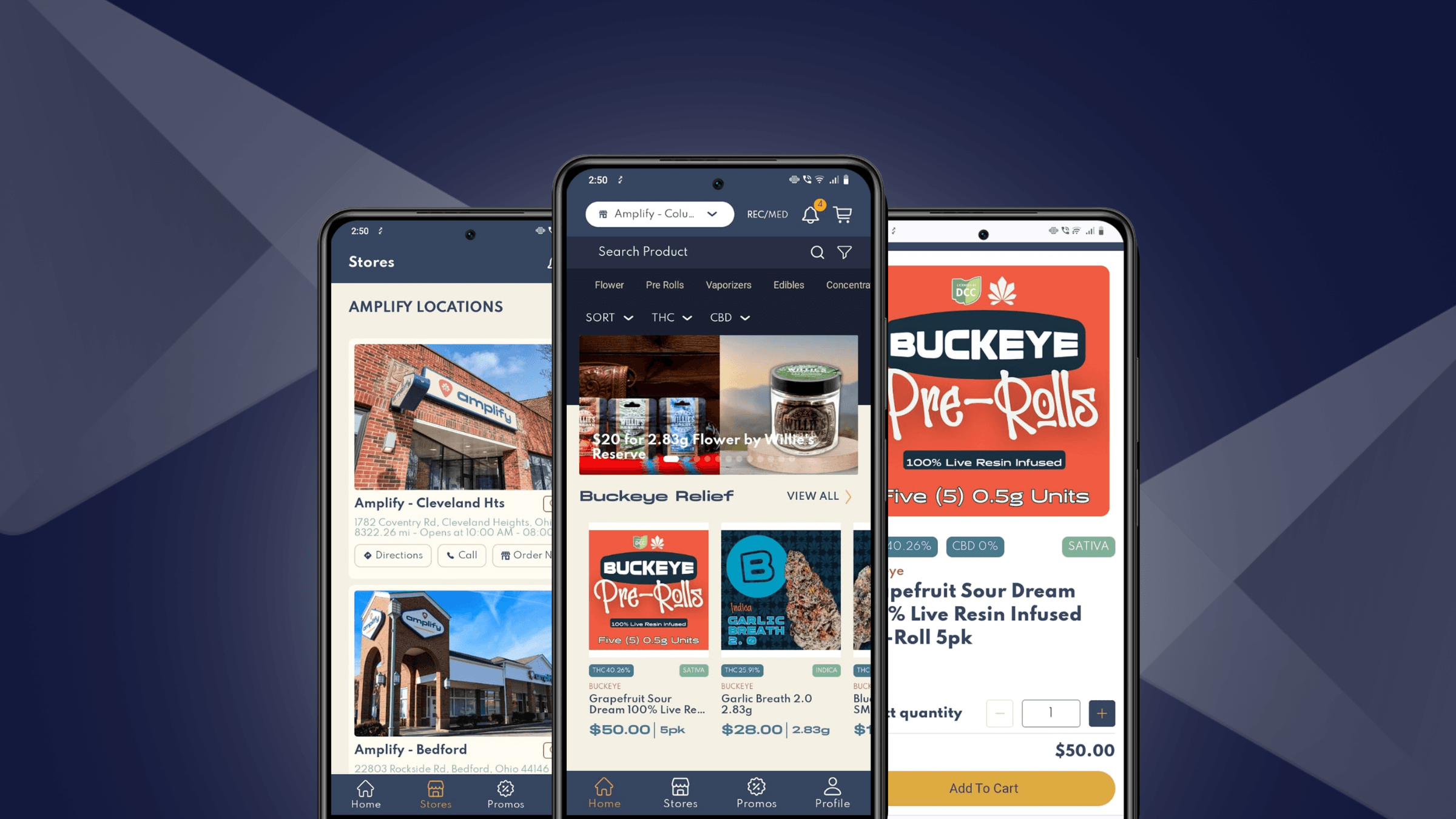

Mobile Channels Triple Customer Visits

Digital Awesome, a leading cannabis app developer, shares valuable insights on the role of mobile channels in driving sales within the cannabis industry. Here's a summary:

- Digital Awesome apps reveal that the average customer spends over $100 per purchase and returns approximately three times a month, according to six months of backend data for a Washington dispensary.

- The app delivered a 34% growth in its user base month-on-month, a trend expected to continue with the implementation of a built-in referral system and other referral-boosting features.

- Digital Awesome's apps have demonstrated a significant user retention rate of 39% within a 30-day period. This is notably higher compared to the average retention rate of standard websites and apps, which stands at 3% and 8% respectively. The user retention rate, measuring the percentage of users who return to an app within a month, is a crucial metric. It not only signifies customer loyalty but also reflects the product's effectiveness.

In essence, the use of mobile channels, particularly apps, can significantly enhance sales and customer engagement in the cannabis industry, leading to higher customer retention and loyalty.

Sources:

"Cannabis Market Data." Headset, 2023, www.headset.io/cannabis-market-data/september-2023-cannabis-market-overview.

"Demographics Report 2023." Headset, 2023, www.headset.io/industry-reports/demographics-report-2023.

Fatemi, Bobby. "Lifetime Value of a Retail Customer in Cannabis." Happy Cabbage Analytics, www.happycabbage.io/post/lifetime-value-retail-customer-cannabis.

Shterenberg, Matthew. "Weedmaps Price Increase - Community Thoughts." LinkedIn, www.linkedin.com/posts/matthew-shterenberg-272235b9_weedmaps-price-increase-community-thoughts-activity-7105553496749318145-Vrs4.

Raymer, Krista. "Hot Take - Stop Doing Cannabis Daily Deals." LinkedIn, www.linkedin.com/posts/krista-raymer_hot-take-stop-doing-cannabis-daily-deals-activity-7105512529543536641-MeZu.

Articles You May Like

7 Ways to Maximize Your App ROI This Green Wednesday

What the Cannabis Industry Can Learn From Nike

Android Users Are Ready to Spend. Is Your Dispensary Ready?